How to create your first budget in BadaChing

1. Have a look at your Income

First determine how much you get paid and when.

If you receive a monthly salary, take note of the net income amount and the payment date.

If you freelance, are self employed or simply don’t receive a regular pay check, you may need to look at your income over the past year and divide by 12 to get a good idea. Remember to subtract taxes.

You may also receive more than one type of income. Note any additional income such as a side hustle or an investment withdrawal.

2. Have a look at your Expenses

Next, you’ll want to put together a list of your usual monthly expenses. Group these expenses into categories that make sense. Here are some common expense categories:

- Rent or mortgage payments

- Loan payments (such as student, auto and personal)

- Insurance (such as health, home and auto)

- Utilities (such as electricity, water and gas)

- Phone, internet, cable and monthly streaming subscriptions

- Child care

- Groceries

- Travel (such as gas, train tickets and bus/taxi fares)

- Household goods

- Health (such as Gym memberships or Fitness classes)

- Entertainment and Dining

- Miscellaneous (such as, gifts, hair salons and apparel)

3. Determine how much you need or want to Save

Savings form a key component of your budget.

BadaChing has a dedicated category for transactions into and out of savings, and this category is automaticallt included in the budget that you will create later.

You can track and view your savings on all reports.

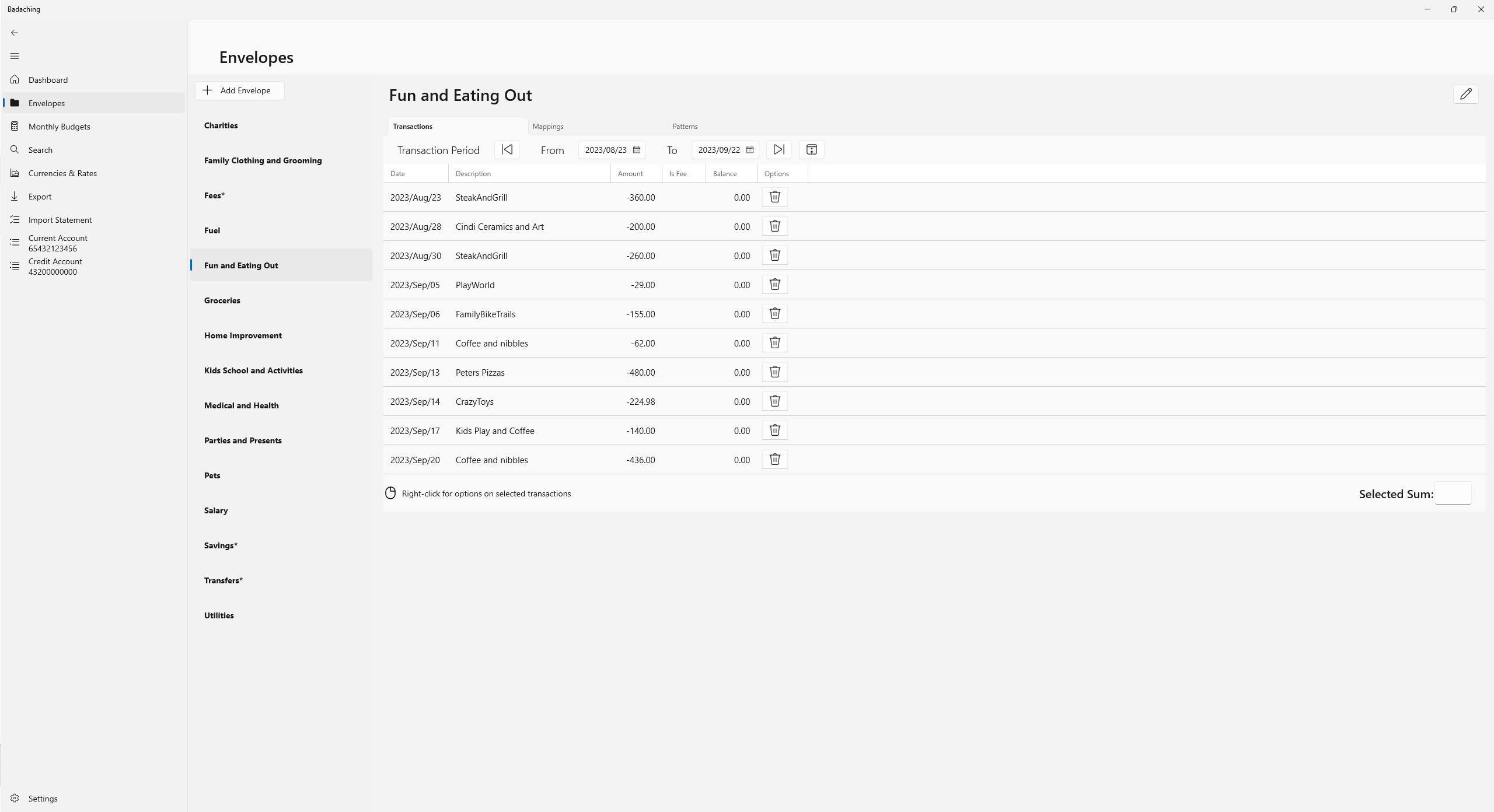

4. Define your Envelopes in BadaChing

Now you are ready to start BadaChing. Define preferences such as your budget period start day and currency.

Next you will want to define your Envelopes in BadaChing. This simply means that you will create the categories for your various expenses and incomes.

5. Import your bank statements into BadaChing

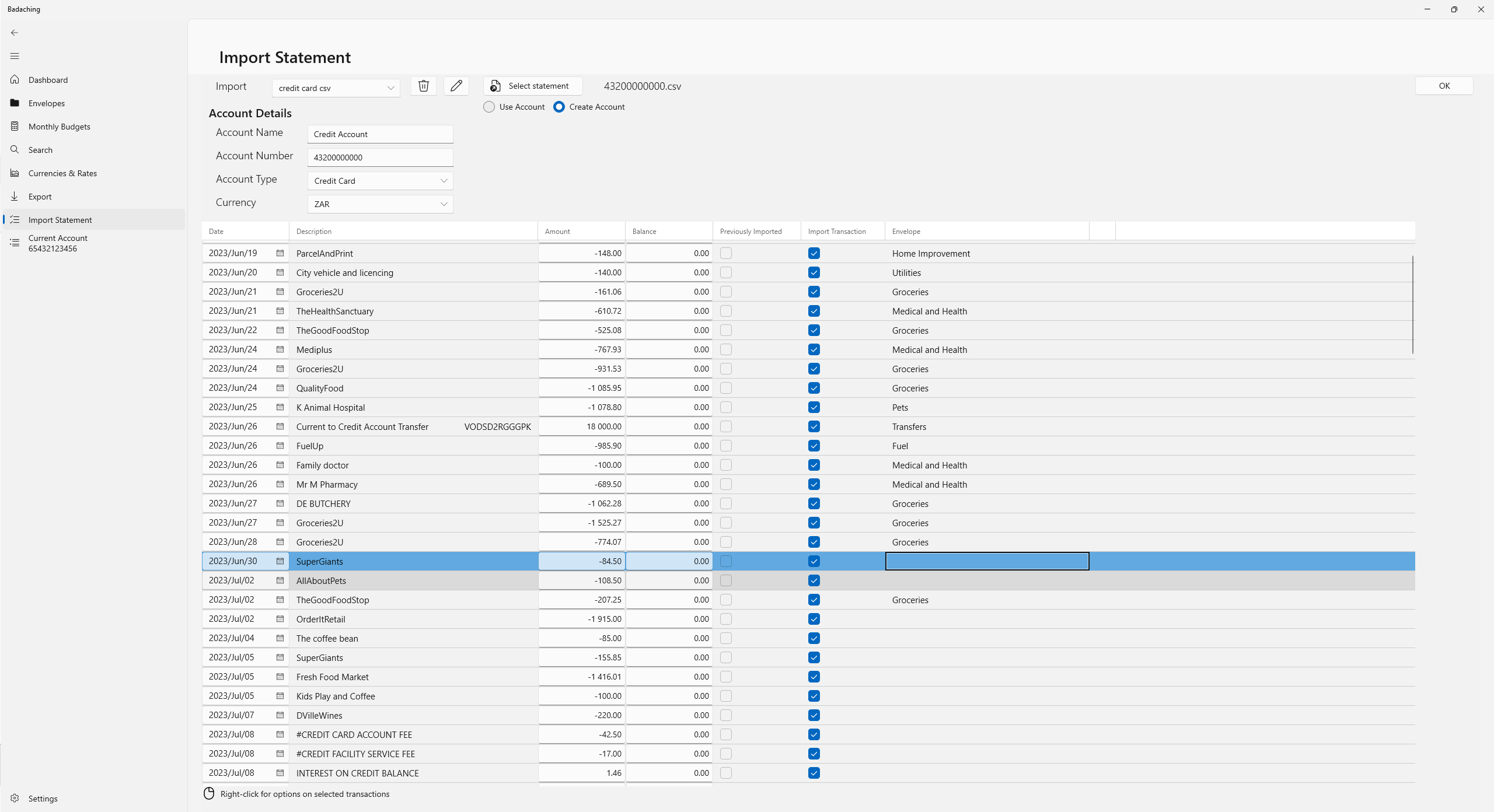

Note that BadaChing does not connect to your bank, nor does it store your bank login details.

You choose to download transaction histories or monthly bank statements into a safe location. BadaChing supports both CSV and OFX files.

Once you have downloaded your files, import your statements into BadaChing. Categorize your transactions right here on the Import screen. You can also categorize transactions on the Account screen.

The more frequently you do it, the easier it gets. BadaChing learns and remembers your transaction mappings; thereby you save time.

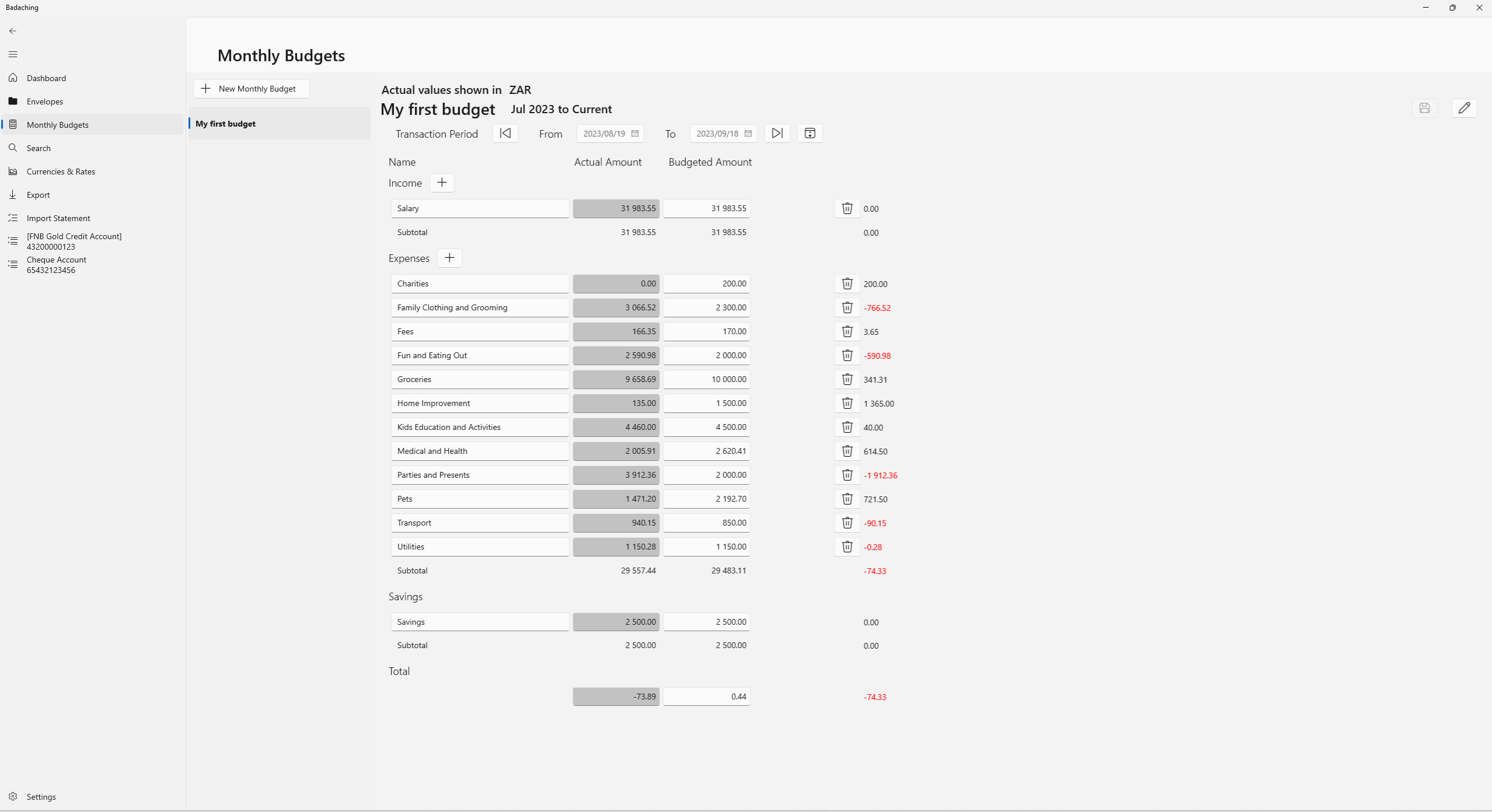

6. Create a Monthly Budget

A BadaChing budget starts with actual transaction values. Wait until you've imported transactions for a good representative month before you create your first budget.

Once you have draft budgeting amounts, you can scroll to previous months to see if your new budget is a good fit or if some amounts need changing.

Remember that expenses may be fixed or variable.

Fixed expenses are bills you likely can’t avoid; and the amounts typically don’t change too much: rent, utilities, transportation, insurance and debt repayments.

Variable expenses tend to be more flexible, for example how much you spend on dining out. For these you want to find your average spend.

The last step in creating a budget is to compare your net income to your monthly expenses. If you notice that your expenses are higher than your income, you’ll need to make some adjustments.

For instance, let’s say your expenses amount to 300 more than your monthly net pay. You should review your variable expenses to find ways to cut costs in the amount of 300. This may include reevaluating how much you spend on groceries, household goods, streaming subscriptions and other flexible costs.

Once you are ready, you can promote your budget to the final version.

7. Allocate Savings

It’s a good idea to try and reduce variable costs so that your income is greater than your expenses. Money not spent should ideally be transferred to a separate savings account, investment, or home loan, especially if you don’t have an emergency fund. You could also use your savings account to save up for on non-essential things like holidays and traveling.

8. Next Steps

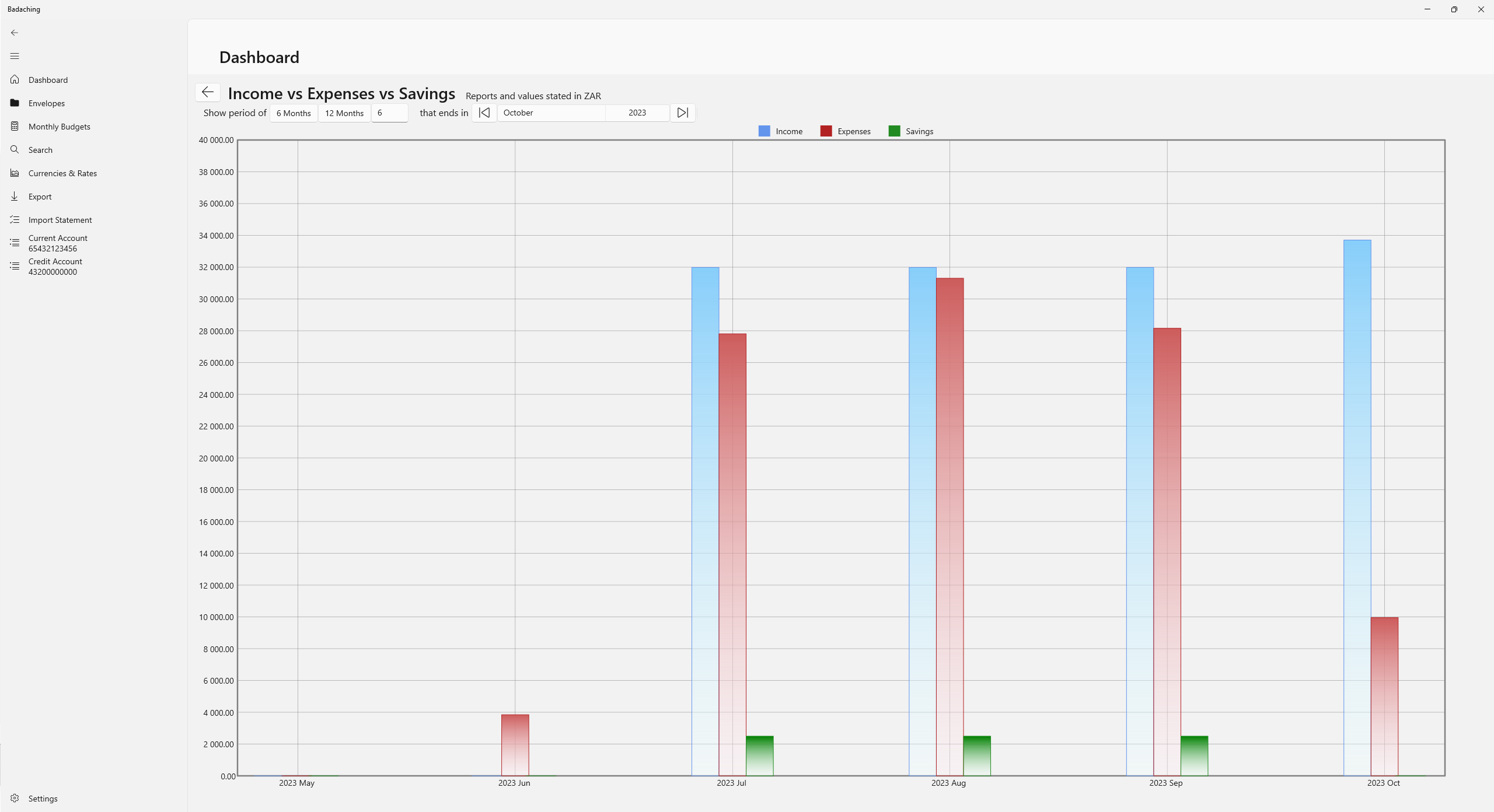

After you finished creating your first budget, the next step is to stick to it. Track all your expenses by regularly importing your statements into BadaChing. You can import account transaction histories often as you like. The more often you do it, the better you will be able to track your actual spend.

It’s a good idea to review your Monthly Budget regularly. Use the dashboard to analyze any changes in your monthly expense patterns, so that you stay within your monthly budget and avoid debt. You can update your budget or define a new one if you enter a new financial period in your life.

And if you share expenses with someone else, make sure you’re both on the same page. Each of you should create his own personal budget in BadaChing and keep each other on track.